Get a Demo

See your data in HubiFi < 2 days

Stripe struggles with any level of complexity. Even standard variations like upgrades, seat changes, pre-paid invoices, and multi-year contracts results result in incorrect revenue recognition.

Have more than one system? Stripe only processes its own data and isn’t GAAP compliant. Teams often have to run multiple reports, reconcile the data on their own in a spreadsheet, and build some summary to upload to their GL to close the books.

Out of period adjustments, prorations around discounts, and double counting on prepayments or discounting invoice line as contra incorrectly but prorates the invoice discounts overtime. That means Stripe is a black box. You can't trust it for financials and might even need to reinstate revenue.

Other rev rec tools are rules-engines that make accounting or a consultant configure and manage rev rec rules.

HubiFi is purpose built and attested ASC 606 calculator that performs all of the O2C cash accounting in the revenue cycle.

See how we compare to the most common vendors in the space here.

The primary ways companies have solved rev rec in the past are:

-Zuora/RevPro or similar tool

-Stripe rev rec

-Netsuite ARM

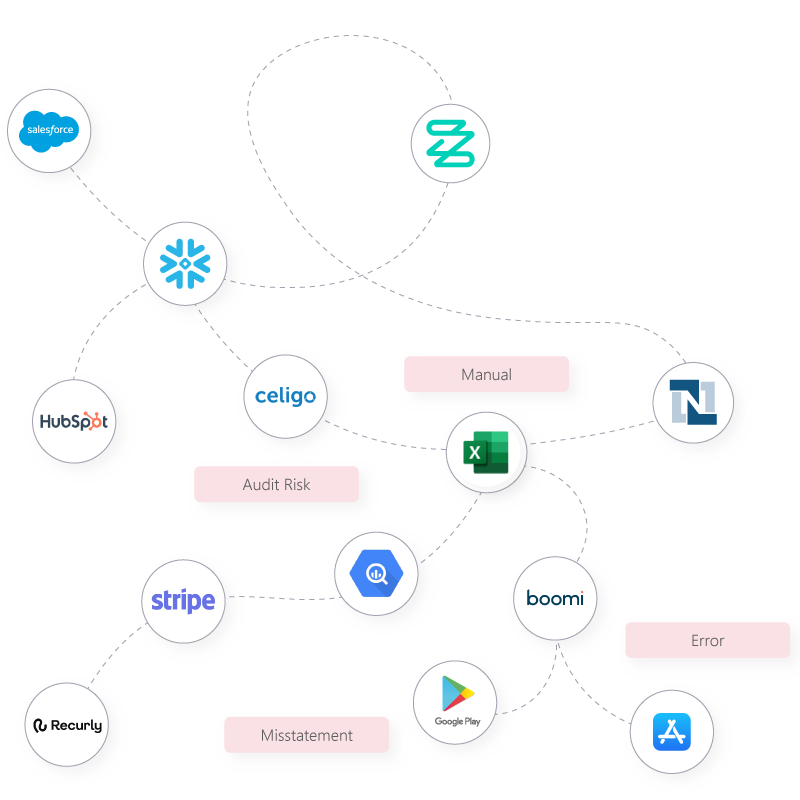

-Generic iPaaS/ETL tool like Boomi, Celigo, Workato, or Alteryx

-Internal build

There are 5 main reasons people switch to HubiFi from those:

1) Lower total cost of ownership - The maintenance costs for tools requiring manual intervention for rule setting and contract modification accounting are high in: pricing, manual effort, internal controls, and audit costs.

2) More accurate and useful revenue reporting for the business - Legacy rev rec tools book entries that lack the granularity needed for useful reporting. HubiFi enriches revenue accounting with operational data, providing FP&A a single source of truth tied to the GL.

3) Operational Flexibility/Scalability - HubiFi implements and integrates with new systems within weeks, not months. As such, it removes friction for up stream system selection for Operations and let’s accounting and finance move as fast as the business changes.

4) Audit Risks & Risk Reduction - Legacy rev rec tools require many points of manual intervention, raising risk around compliance and accuracy. HubiFi removes this manual intervention and derisks the O2C accounting cycle.

5) Revenue Leakage - Most teams know there is a level of revenue leakage in the current manual parts of the process. HubiFi identifies these during implementation, confirming the hunch and often providing immediate ROI. See why Hubifi here.

HubiFi sits between your contract, billing, and payment systems and your general ledger to perform the full order to cash cycle accounting.

Yes. HubiFi is source system agnostic.

Yes. HubiFi is GL agnostic. Most customers start with a manual GL upload file that they can download and post. But HubiFi can also integrate to post entries automatically to your GL.

No. HubiFi connects to all of your upstream contract, billing, and payment systems to perform automated and accurate rev rec and O2C accounting. Pick what systems work best for your business and use HubiFi to automate the rev rec and order to cash accounting.

Our prices are flat fee for the term. Not by seat, transaction, or volume.

Pricing is based complexity and number of integrations in the O2C cycle.

Check our pricing here.

1-6 weeks, with most customers under 4 weeks.

Implementation means: Reconciled to source systems for C&A, reconciled to your GL, and you’re comfortable with the accounting and you are processing your O2C accounting daily with HubiFi.