The primary ways companies have solved rev rec in the past are:

-Zuora/RevPro or similar tool

-Stripe rev rec

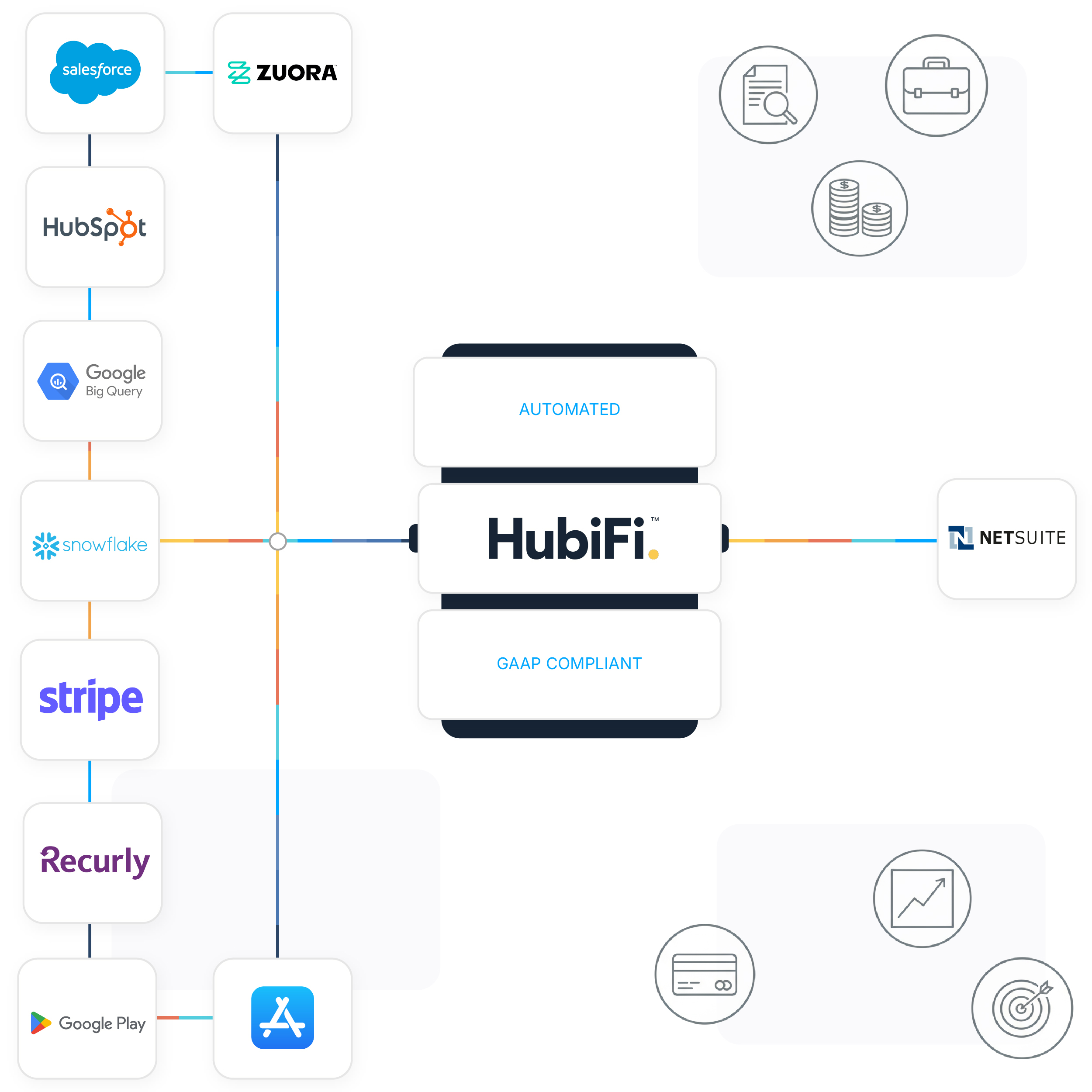

-Netsuite ARM

-Generic iPaaS/ETL tool like Boomi, Celigo, Workato, or Alteryx

-Internal build

There are 5 main reasons people switch to HubiFi from those:

1) Lower total cost of ownership - The maintenance costs for tools requiring manual intervention for rule setting and contract modification accounting are high in: pricing, manual effort, internal controls, and audit costs.

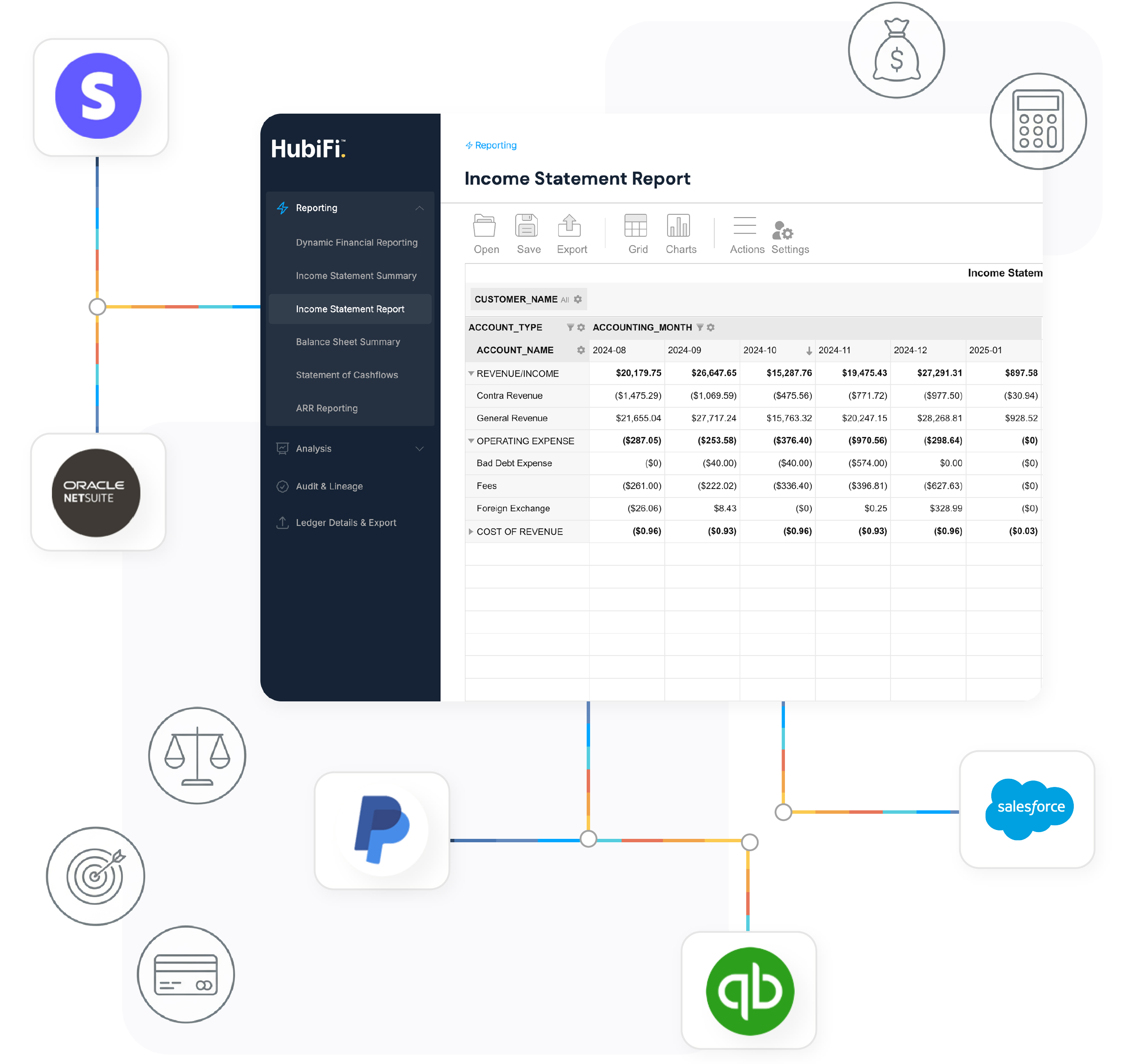

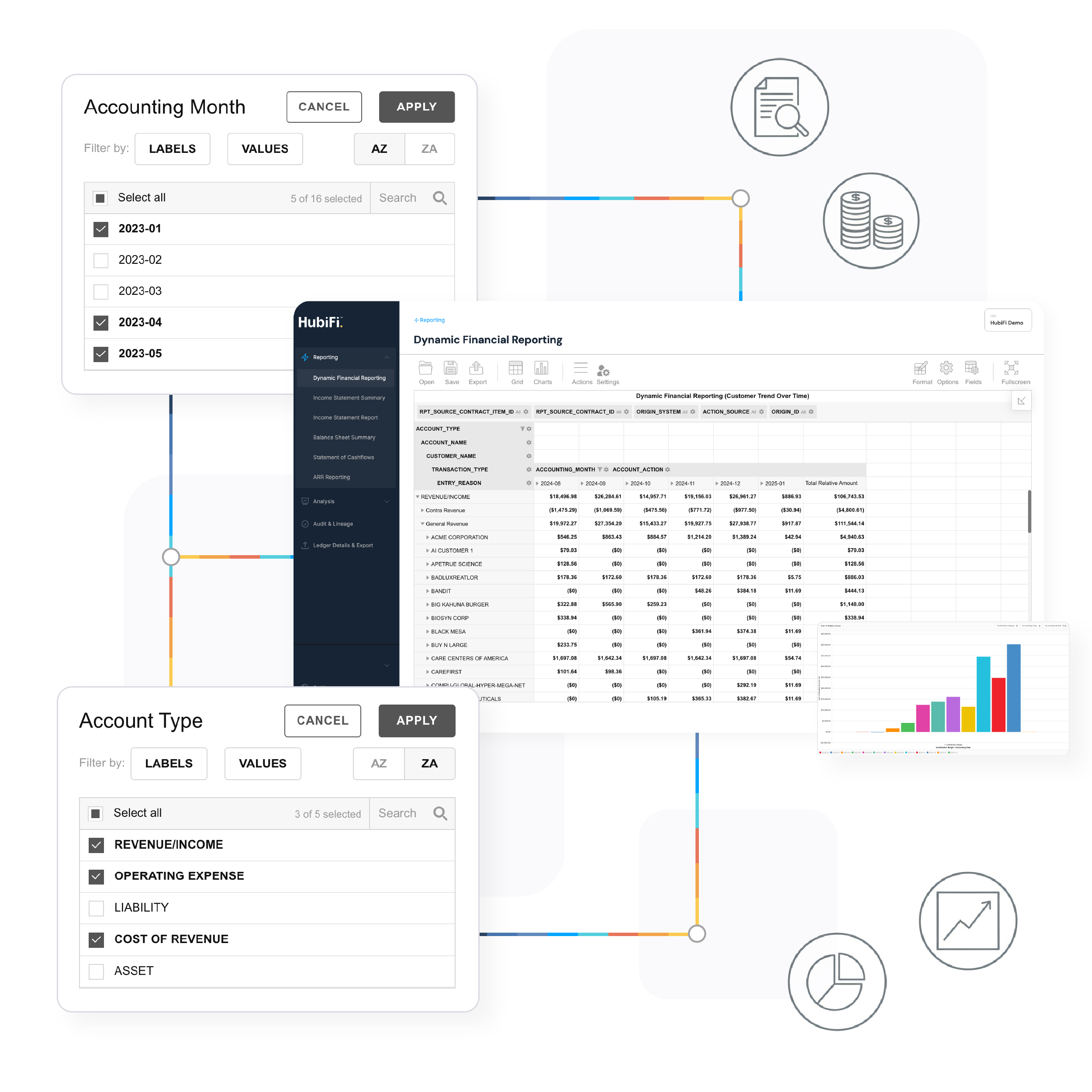

2) More accurate and useful revenue reporting for the business - Legacy rev rec tools book entries that lack the granularity needed for useful reporting. HubiFi enriches revenue accounting with operational data, providing FP&A a single source of truth tied to the GL.

3) Operational Flexibility/Scalability - HubiFi implements and integrates with new systems within weeks, not months. As such, it removes friction for up stream system selection for Operations and let’s accounting and finance move as fast as the business changes.

4) Audit Risks & Risk Reduction - Legacy rev rec tools require many points of manual intervention, raising risk around compliance and accuracy. HubiFi removes this manual intervention and derisks the O2C accounting cycle.

5) Revenue Leakage - Most teams know there is a level of revenue leakage in the current manual parts of the process. HubiFi identifies these during implementation, confirming the hunch and often providing immediate ROI. See why Hubifi here.